Solayer Introduces Yield Bearing Stablecoin in Collaboration with OpenEden

Backed by U.S. Treasury Bills, Solayer’s $sUSD enables holders to secure Solana-integrated applications while earning additional yield.

Solayer, Solana’s leading restaking protocol, has added other native asset to its expanding product suite. After attracting over $200M in TVL in September, Solayer is dynamizing its platform further with the unveiling of $sUSD, a yield-bearing stablecoin.

Partnering with OpenEden, a tokenized Treasury Bill issuer, $sUSD enables users to earn yield on deposited $USDC, with provided capital being used to further secure the Solana-integrated systems.

What is $sUSD?

Solayer’s $sUSD bears the unique title of being Solana’s first yield-bearing restaking stablecoin. Collaborating with OpenEden, $sUSD is backed by U.S. Treasury Bills, one of traditional finance’s most historically resilient assets.

Similar to how current users can deposit $SOL in exchange for $sSOL, Solayer’s liquid restaking token, Solayer’s new yield-bearing stablecoin enables users to swap their $USDC for $sUSD. Using Solana token extensions, yield generated through $sUSD will automatically rebased to holders.

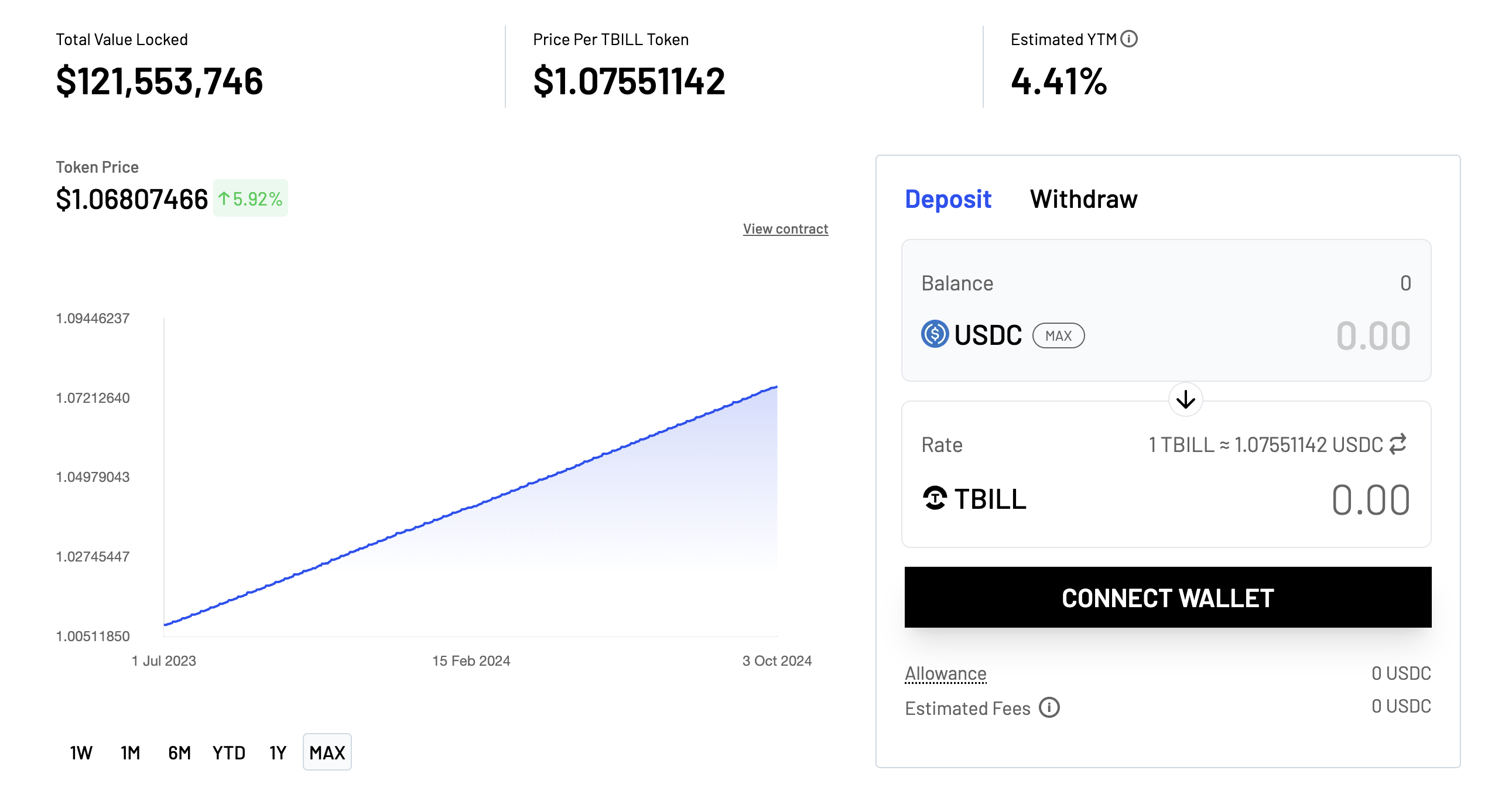

Holding $sUSD allows depositors to earn consistent yield backed by OpenEden’s tokenized T-Bills. Since launch, OpenEden’s flagship product has shown remarkable stability, providing consistent yields of 4-5% APY while amassing over $121M in TVL.

To facilitate $sUSD deposits and redemptions, Solayer has developed a decentralized RFQ (Request For Quote) protocol. As Solayer’s network of providers expands, the RFQ marketplace will enable users to get the best possible $sUSD exchange.

From launch, $sUSD will be integrated into a host of Solana DeFi applications, enabling $sUSD to be used in a vast array of DeFi strategies. Additionally, $sUSD is expected to be used as a consensus asset to secure Solana-integrated systems like SVM (Solana Virtual Machine) Layer-2s, oracles, and bridges.

While $sUSD is Solana’s first yield-bearing restaking stablecoin, it’s not the first yield-bearing stablecoin in the ecosystem. In June 2024, Ondo Finance launched $USDY.

$sUSD is expected to go live within the next two weeks.

Solayer TVL Growth Stalls Amidst Turbulent Markets

One of Q3’s strongest performers, Solayer enjoyed surging TVL (Total Value Locked) powered by month-on-month growth. At its peak, Solayer amassed over $200M in TVL, with Solana DeFi users eager to deposit assets to the restaking protocol.

While Solayer offers generous yield and a unique value proposition, Solana users have flocked to the protocol in anticipation of a future airdrop. Speculation intensified further following completion of Solayer’s $12M funding round, which was led by Polychain Capital and saw participation from the likes of Binance Labs and Big Brain Holdings.

Recent geopolitical tensions have led to a slight decline in Solayer TVL. After recording over $208M on September 30, Solayer TVL has slumped back to $180M, representing a 13% decline.

However, this drop is largely due to $SOL price action, rather than users withdrawing funds from the platform. When denominated in $SOL, Solayer TVL is only down 4.47%, based on DeFiLlama data.

Competition in Solana’s restaking market is heating up, with alternative protocols, such as Jito and Fragmetric, working on delivering restaking services to the network.

Read More on SolanaFloor

DeFi on Solana continues to challenge crypto’s biggest Layer-1

Solana Reclaims Weekly DEX Volume Crown from Ethereum Layer One

How Do Stablecoins Work?