Solana Governance Proposal Seeks to Transform $SOL into ‘Ultra-Sound Money’

Multicoin Capital proposes a new programmatic $SOL emission schedule.

A new Solana governance proposal could transform $SOL into a deflationary asset. Submitted by Multicoin Capital Executives, SIMD-0228 aims to implement a new programmatic $SOL emission schedule, optimizing blockchain economics and reducing token inflation.

Multicoin’s proposal aims to take advantage of validators’ diminishing reliance on staking emissions. Factoring in the network’s burn rate, SIMD-0228 could help $SOL’s transition into a deflationary asset.

What is SIMD-0228, and will it help Solana steal Ethereum’s ‘Ultra-Sound’ Money title?

SIMD-0228: Solana’s New Programmatic Inflation Rate

SIMD-0228 is a recent governance proposal submitted by Multicoin Capital Executives Tushal Jain and Vishal Kalkani. Spurred on by Solana’s MEV rewards and exploding economic activity, Jain and Kalkani assert that the time has come for the network to evolve, stepping away from a fixed-emission schedule to a programmatic, optimized design.

In typical Proof-of-Stake blockchains, validators and stakers are incentivized to secure the network in exchange for token emissions. Solana’s current schedule was originally set at 8%, and will steadily decrease by 15% per year until stabilizing at 1.5% around 2030.

However, Solana’s flourishing onchain ecosystem has reduced validator dependence on emissions for profitability, allowing for further economic network optimizations.

SIMD-0228 proposes the implementation of ‘Smart Emissions’ which dynamically change token emissions based on staker participation. When staker participation is low, emission rates increase to bolster network security and encourage stake growth. When staker participation is high, reduced emissions facilitate sustainable market dynamics and enhance $SOL DeFi usage.

In its first iteration, SIMD-0228 sets a target staked SOL percentage of 50%. If less than 50% of $SOL supply is staked, emissions increase. Conversely, emissions decrease if more than 50% of $SOL supply is staked. The Upper Bound of the emission rate is set to Solana’s current inflation schedule, while the Lower Bound of 0% would temporarily pause emissions.

Prominent Solana network figures have come out in support of the proposal, with Anza engineer trent.sol championing the suggested changes.

Initial reactions to the proposal have been overwhelmingly positive. Network participants are excited by the prospect of reduced $SOL emissions, which is believed to diminish sell pressure and support $SOL value accrual. SIMD-0228 is expected to be further supported by another Multicoin governance proposal detailing long-term staking.

Ultra-Sound SOL

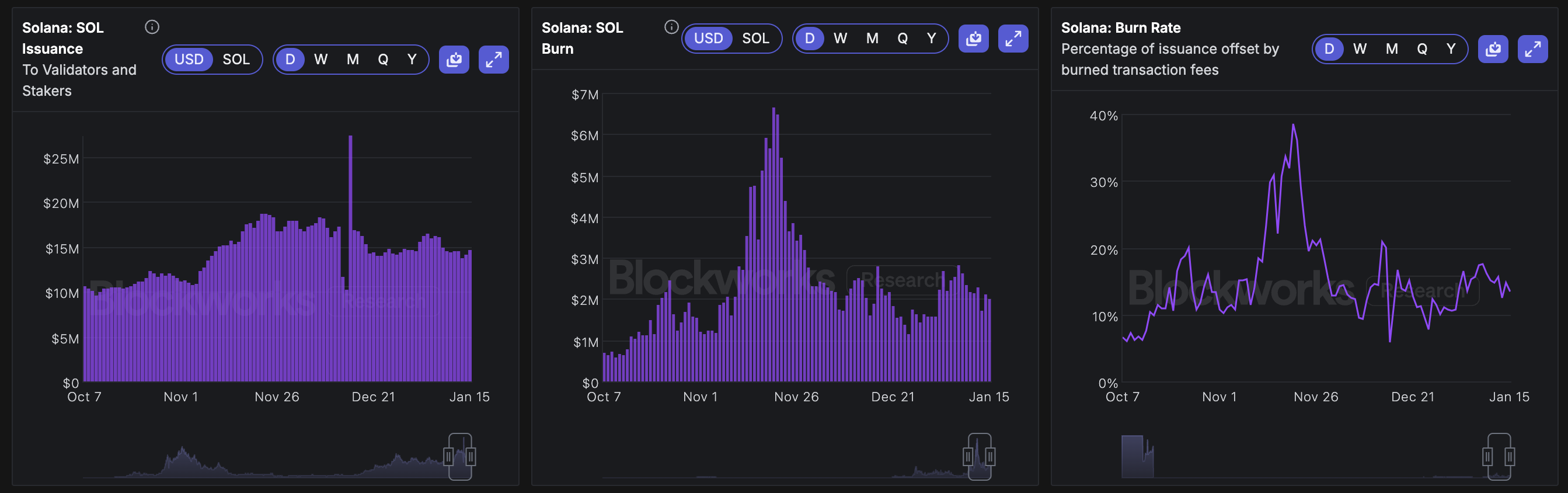

Currently, Solana’s network economics enforce a 50% burn on all transaction fees. While this deflationary mechanic counters $SOL emissions, they are still far from completely offsetting token inflation.

According to Blockworks data, Solana’s burn rate, or the percentage of issuance offset by token burns, typically hovers between 10-20%, dependent on network activity.

“With the current staking participation rate of ~70%, the network would see a reduction of inflation of 1% p.a.” - SIMD-0228

Given Solana’s current inflation rate of ~4.7%, a 1% p.a. inflation reduction would result in a ~20.9% drop in token emissions.

While this reduction would hardly flip $SOL into ‘Ultra Sound Money’, surging network activity could dramatically close the gap between emissions and burns and potentially turn $SOL into a net deflationary asset.

Read More on SolanaFloor

Is Vector going to become Tensor’s flagship product?

Vector.fun Enjoys Near 8x Revenue Growth in December

What is Solana Staking?