Solana Dominates Fee Generation and DEX Volume While Ethereum Suffers Outflows

Solana, Raydium, and Jito are independently generating more fees than Ethereum.

The Solana ecosystem continues to command market share and dominance from Ethereum, the crypto industry’s largest Layer-1 blockchain.

The frequency with which Solana outperforms Ethereum in key metrics is steadily becoming more common.

In the past, Solana would eclipse Ethereum’s onchain trading volume, fee generation, and network activity only during isolated events. These days, the network is starting to assert its dominance more often, and over longer periods.

Solana Ecosystem Fees Boom

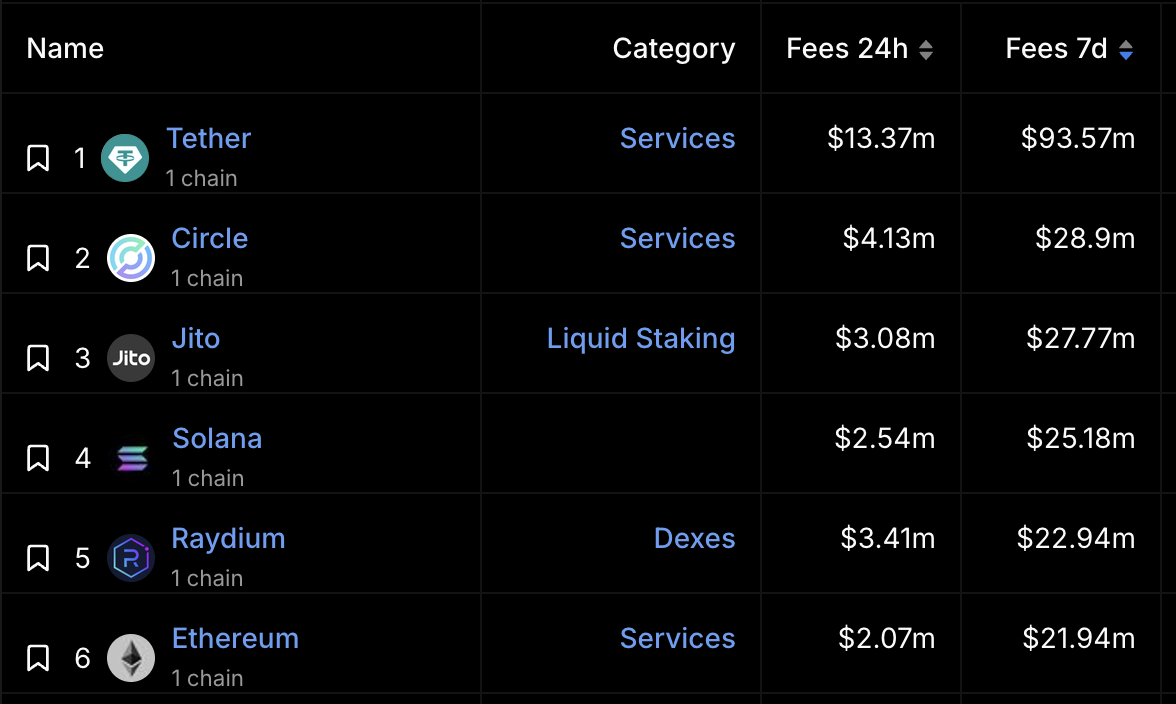

Fuelled by explosive trading activity, fee generation across the Solana ecosystem has surged. Aside from stablecoin issuers like Tether and Circle, Solana and Solana-based applications are the highest fee generators across the entire blockchain industry over a weekly time frame.

According to DefiLlama data, Jito Labs, Raydium, and the Solana network have all independently flipped the Ethereum in fee generation. In the last seven days, each of these protocols has generated over $22M, with Jito Labs surpassing crypto’s biggest Layer-1 by a margin of 26.57%

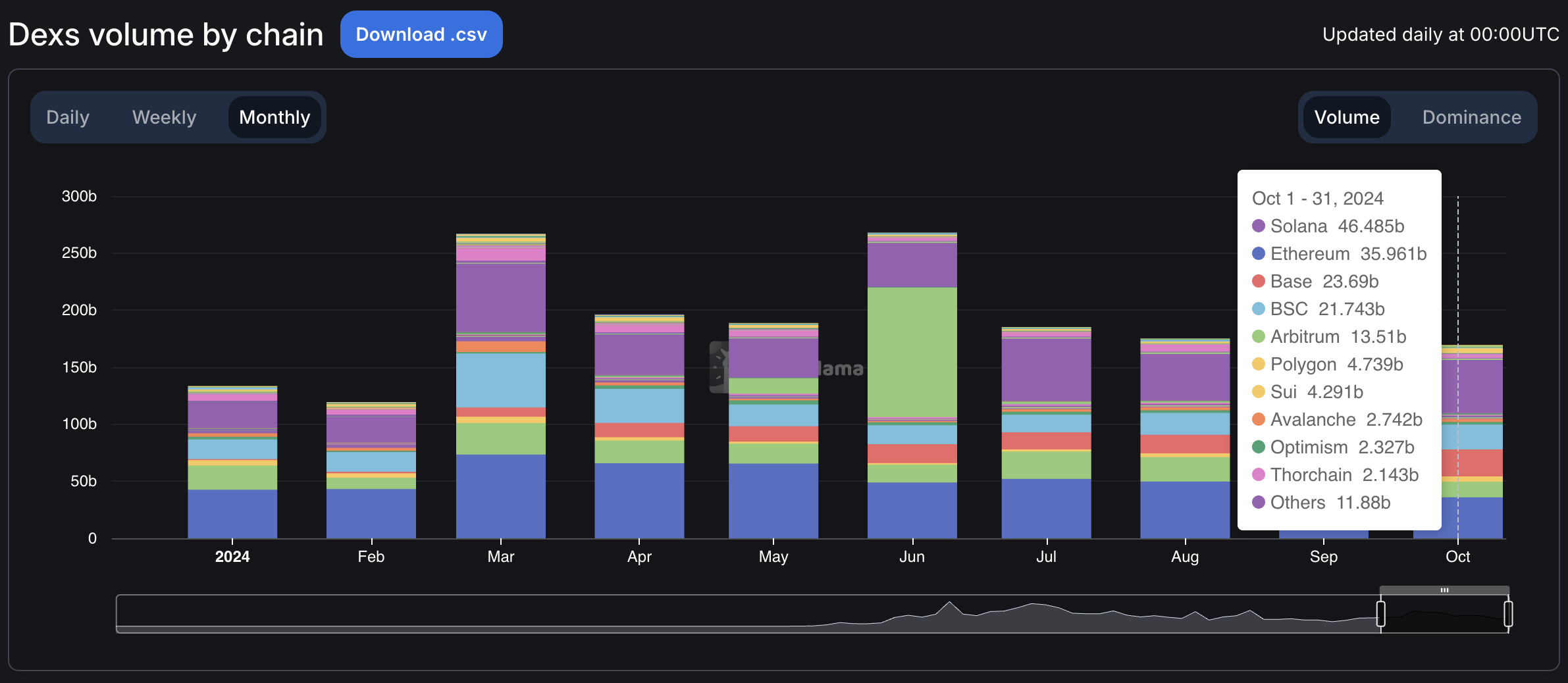

Solana’s onchain dominance is further reinforced by its superior spot trading volume of decentralized exchanges. Commanding 35% of market share across all blockchains, Solana recorded a new all-time high in DEX trading volume dominance.

At this rate, Solana is expected to lead all networks in monthly DEX trading volumes for the second time this year after surpassing Ethereum’s reign in July 2024.

Solana’s prolific growth and newfound dominance as the central hub of onchain trading activity has sparked questions regarding its valuation against rivals.

Amongst the chain’s growth, social media commentators have eagerly highlighted that despite leading Ethereum in several critical metrics, Solana still trades at roughly a quarter of the original Layer-1’s market capitalization.

Net Stablecoin Inflows Up $256M in 7D

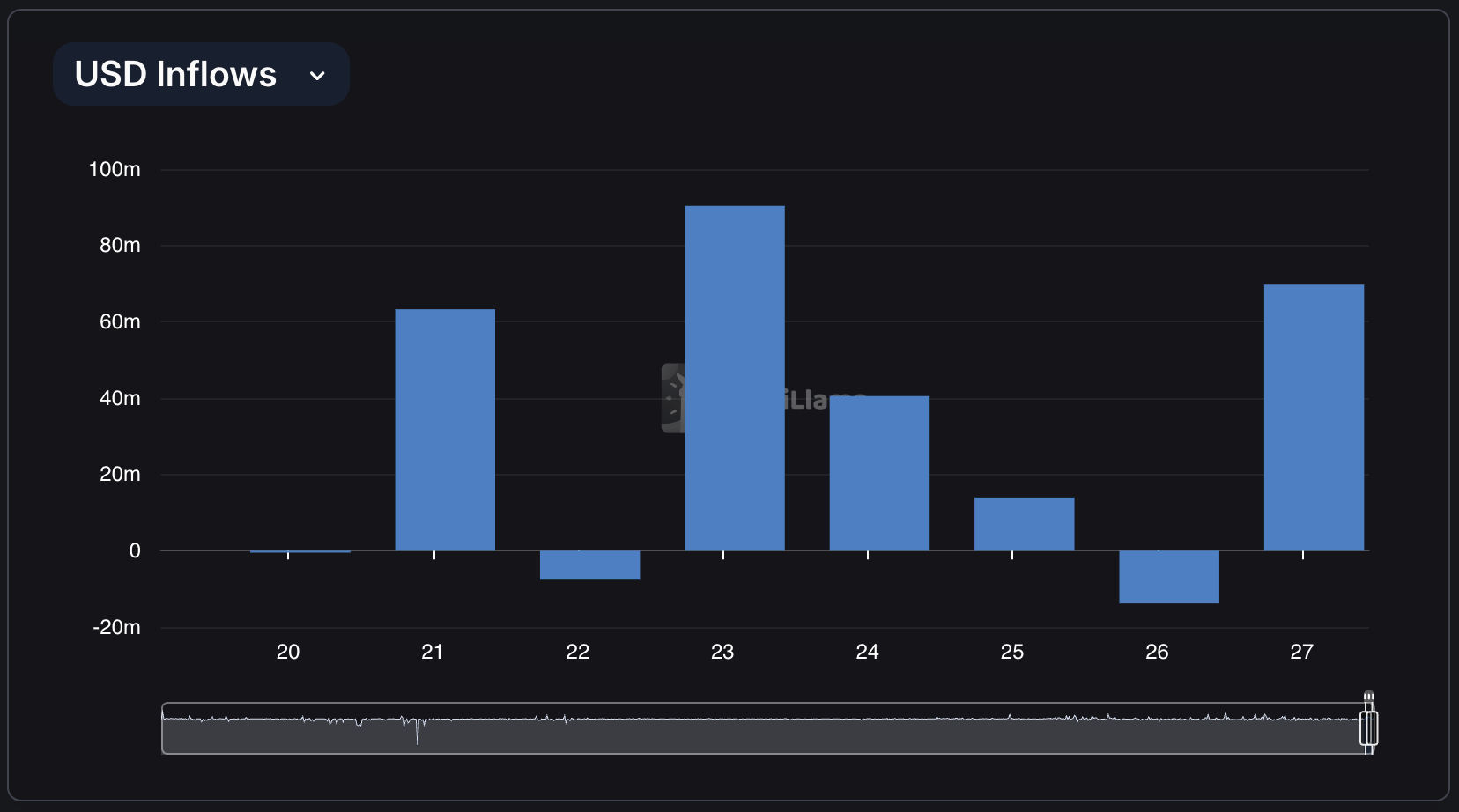

Solana DeFi’s historic week extends beyond meteoric trading volumes and high fee generation. The ecosystem has also witnessed considerable net stablecoin inflows, indicating that traders are eager to deploy capital and deepen liquidity within the ecosystem.

Over $256M worth of stablecoins have been bridged over to the Solana network in the last seven days. This reflects onchain traders growing appetite for establishing a presence in the Solana ecosystem.

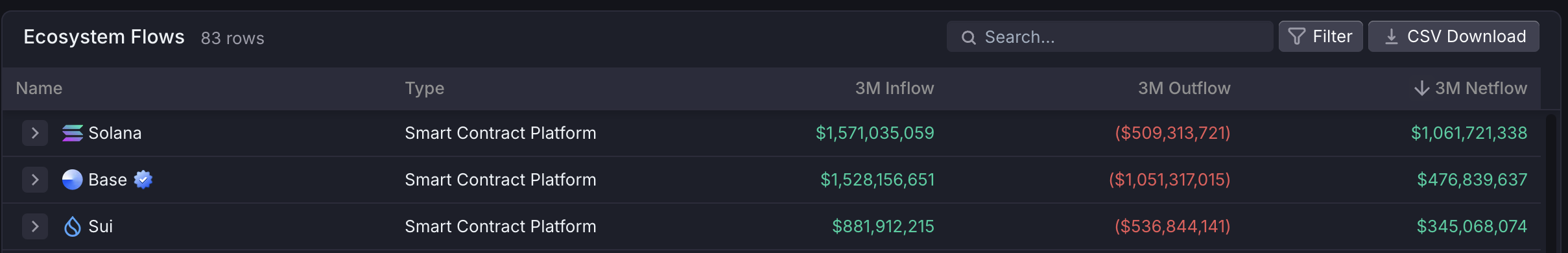

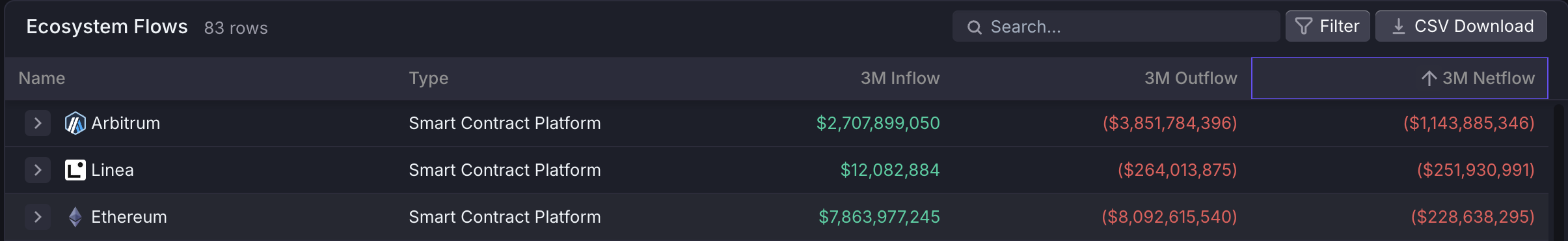

This trend is further reinforced by industry-wide netflows. According to Artemis data, Solana has led all blockchains in net inflows over the past three months, attracting over $1B USD of funds from alternative chains.

Comparatively, Ethereum is the third-worst-performing chain, suffering over $228M in netflows during the same time frame.

What if ‘The Flippening’ Isn’t ETH/BTC?

Since Ethereum launched back in 2015, ETH supporters have eagerly awaited ‘The Flippening’: the landmark moment when $ETH surpasses $BTC in market capitalization.

However, with ETH/BTC currently trading at its lowest point since April 2021 and Solana leading this cycle, crypto enthusiasts are beginning to ask if ‘The Flippening’ could mean something else entirely.

While ETH/BTC sits at multi-year lows, SOL/ETH currently trades at all-time highs. Inspired by Solana’s bullish momentum, $SOL holders have attributed a new vision to ‘The Flippening’, hoping to see their preferred Layer-1 rise to the top.

More cynical players have highlighted how discussions of ‘The Flippening’ have previously marked euphoric peaks in previous cycles, suggesting that Solana bulls should remain objective when assessing their positions.

Read More on SolanaFloor

Get ready for GeckoCon in Bangkok

Web3 Gaming Takes Center Stage at GeckoCon 2024

What’s the Difference Between Solana, Bitcoin, and Ethereum?