Solana Defies Market-Wide Trend, Leads Weekly Inflows

In the face of a difficult week for the cryptocurrency market, Solana leads digital asset product inflows.

Continuing to defy the expectations of the wider crypto market, Solana has outperformed digital asset rivals like Bitcoin ($BTC) and Ethereum ($ETH).

During a forgettable week for crypto markets, Solana has bucked the bearish trend, enjoying positive inflows amidst a sea of red.

SOL Leads Weekly Inflows Across Top Digital Assets

While much of the crypto market succumbed to bearish forces last week, Solana showed plenty of resilience. According to CoinShares data, Solana digital asset products attracted over $7.6M in net inflows, outperforming both Bitcoin (-$319M) and Layer 1 rival Ethereum (-$5.7M).

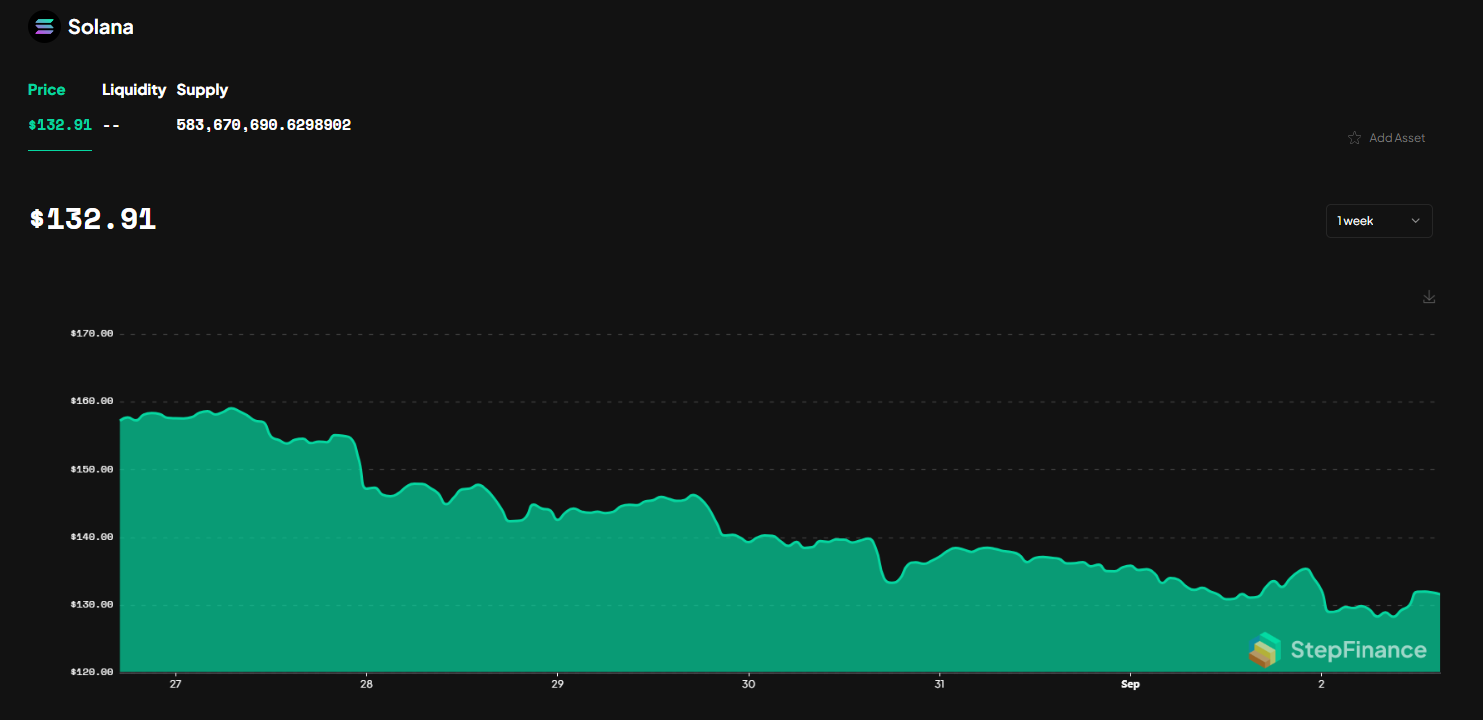

However, despite positive inflows in digital asset products, $SOL price suffered a significant decline. Over the past week, Solana has dropped 15.45%, sliding from $157.2 to currently exchange hands at $132.91, based on Step Finance data.

In this sense, Solana has underperformed both $BTC and $ETH, which lost 7.5% and 7.3% respectively over the same period.

The diverging trends highlight a curious dynamic. Despite Solana suffering a more significant price drop than both $BTC and $ETH, institutional inflows for Solana-based digital asset products were positive.

Solana’s favorable performance suggests higher demand from institutional investors and traders, who are taking advantage of turbulent market conditions to establish positions heading into Q4.

Alternatively, the comparatively smaller range of Solana-based products allows for a reduced sample size, which could skew results. The abundance and accessibility of Bitcoin and Ethereum ETFs mean that these assets are likely to witness more consistent trading behavior.

Monthly Stablecoin Inflows Increase by 21%

Beyond positive digital asset product inflows, the Solana network also enjoyed increased stablecoin flows.

Having continually grown throughout 2024, Solana’s monthly stablecoin inflows increased by 21%, rising from $371M in July to $449M in August.

The growth indicates a growing desire for greater liquidity onchain. The trend is further supported by an increase in the total value of bridged assets arriving on the Solana network.

According to data provided by deBridge and Artemis, over $345M worth of assets were bridged to Solana from alternative chains, a 23% increase from the $280M bridged in July. August’s bridge traffic included over $279M from Ethereum, the industry’s largest Layer 1 network.

The inflow of capital suggests that investors and traders could be eager to establish positions in both Solana’s thriving DeFi scene and the ecosystem’s native tokens. With increased liquidity arriving onchain, network participants hope that the Solana ecosystem can maintain its bullish trajectory in Q4.

Read More on SolanaFloor

Why are validators pushing back on Marinade’s new model?

Some Solana Validators Are Concerned by Marinade’s Stake Auction Marketplace

What Are The Benefits of Decentralized Finance?