Save Finance Founder Talks Risk Management, Rebrand, and dumpy.fun Growth

In a SolanaFloor exclusive, one of the network’s oldest DeFi applications discusses risk management, upcoming products, and Solana’s longevity.

Save Finance, formerly Solend, boasts undeniable OG status. As one of Solana’s longest-standing DeFi protocols the Save team has witnessed more ‘end-of-Solana’ moments than most, yet they continue to push the ecosystem forward with innovative new products.

While many original Solana DeFi projects have collapsed or fallen into obscurity, Save remains a key player in the ecosystem.

Speaking exclusively with SolanaFloor at Breakpoint, Save founder Rooter discusses the protocol’s conservative approach to risk management and reflects on the company’s recent rebrand.

“Reacting Quickly and Effectively is the Best Risk Management”

Originally launched in 2021, Save Finance has outlasted some of the most devastating events in recent memory. Having survived a litany of Black Swan events like the Terra Luna crash and the FTX implosion, Save’s risk management practices have assured its resilience in the face of devastating market conditions.

Rooter, Save’s founder, credits the protocol’s durability to its conservative approach to risk management. To mitigate risk, Save relies on internally simulated data that calculates potential liquidation damage.

“We have a lot of internal dashboards that will simulate what happens if the market crashes by 5% to 10%. What about 10%? What about 15%? How much liquidation would occur? We have some alerting there as well, so that if liquidity is very thin, then we'll know about it ahead of time. We're always prepared for the worst-case scenario.”

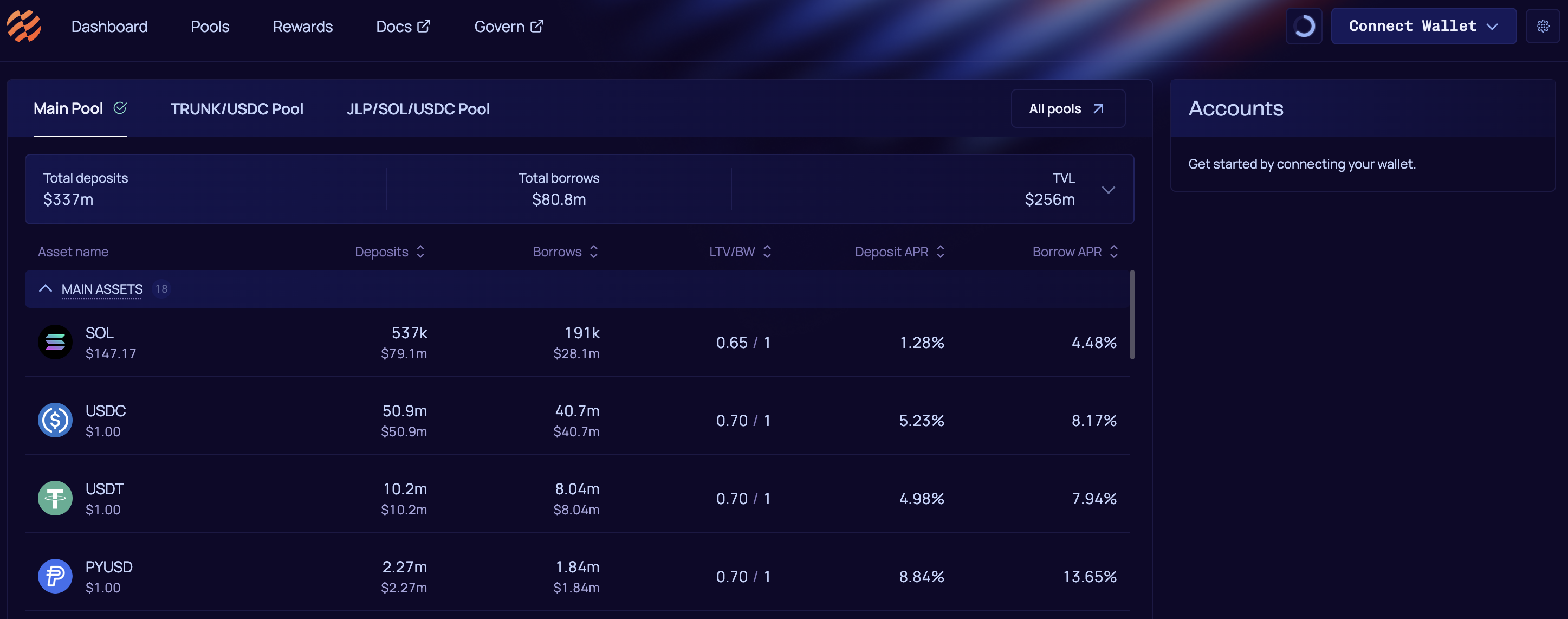

Alongside simulated data, Save also champions a cautious approach to LTV (Loan-to-Value) allowances. This helps users stay in more secure positions instead of over-leveraging their collateral.

“We set our LTVs and parameters very conservatively. So I think out of the different lending protocols on Solana, We're actually the most conservative with our risk. Others have higher LTVs, higher risk.”

However, simulations and conservative LTV rates are only one part of a well-rounded and resilient risk management system. In turbulent conditions, DeFi projects need to be able to react quickly and effectively to protect capital.

Rooter asserts that the Save Finance team has been “heads down” during the bear market, “working on Solana V2 smart contracts.” According to the Save founder, “this adds a lot of new risk handles that we can pull on in the case of an event.”

Additionally, Rooter argues that over-reliance on complicated liquidation simulations can be something of a “red herring”. Drawing on Save’s handling of the $soBTC collapse in 2022, Rooter contends that “at the end of the day, what's a lot more important than [simluaition] is just being able to react quickly. We have a really good on-call and incident response process now after going through so many.”

To support these claims, Rooter added further clarity to Save’s reaction to the $soBTC depeg.

“A lot of different projects in Solana DeFi had that as collateral. We had it as well, but we were, I think, one of the first ones to realize that this was a big risk. We were able to liquidate basically all of the $soBTC out of our systems before withdrawals on FTX were stopped.”

“Whereas there were a lot of other projects where maybe they had a lot of fancy simulations… but then they just didn't realize that this was a thing and didn't react quickly enough, and the doors closed, and all the money was just left in FTX… reacting quickly and effectively is the best risk management.”

Finally, Save Finance has worked with multiple smart contract auditors to ensure that its underlying codebase is secure. Rooter asserts that a “very-long term relationship” with teams like OtterSec means that Save Finance is audited by the leading security firm’s top auditors.

Permissionless Listings Coming to dumpy.fun

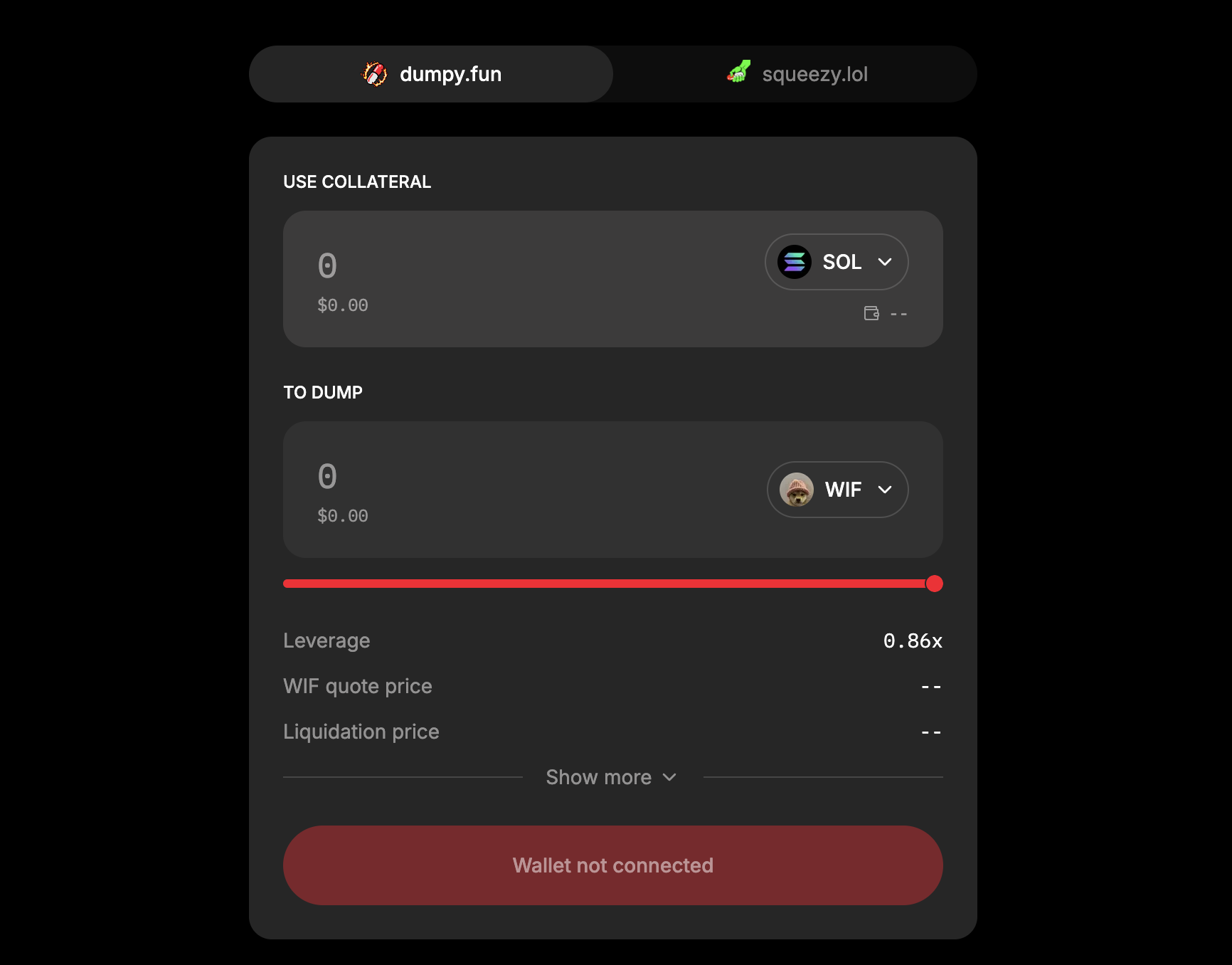

Beyond its recent rebrand, Save Finance has also rolled out one of the market’s most demanded products. dumpy.fun, a memecoin shorting platform, enables traders to earn profits from memecoin price depreciation.

Since its launch, Rooter and the Save Finance team have been pleased with the new platform’s reception and usage.

“Yeah, dumpy.Fun was extremely fun to work on. We got a ton of people using it right at launch, and people were very excited about it. It made for some really good memes and some really good PNLs as 99% of memecoins go to zero, right? So there's a lot of opportunity out there, and dumpy is providing a platform that's kind of unique. You're not able to get short positions on a lot of these things otherwise.”

dumpy.fun continues to expand, with new tokens being listed every day. The team intends to roll out permissionless listings on the platform in the near future, alongside other unannounced features.

“We're working on permissionless listings so that anyone will be able to list their token on day zero. And we've also got something special as well, which I don't want to share too many details, but we did post a manifesto about it. That's the little hint there.”

The Save Rebrand - “It’s Kind of Like Growing Up”

Since its rebrand in July, Save Finance has continued to work on several new DeFi products, including its native LST (Liquid Staking Token) and native stablecoin.

According to Rooter, the main motivation for the rebrand was to establish Save Finance as a diverse and multifaceted DeFi ecosystem, as opposed to solely operating as a lending platform.

“We're expanding beyond just lending with the launch of our new stablecoin. So, yeah, it's just like a good time to elevate the brand. As for the website itself, we did this really big UI refresh. I think the original version that we shipped in 2021 was very nice and clean. But as we added features one by one… things got a little bit cluttered. For a while, I was really wanting to overhaul that. It feels really good to have an app that I'm really proud of to have in production now.”

Adding further clarity to the mechanics of $SUSD, Rooter highlighted how the platform’s native stablecoin provides a unique proposition for Solana DeFi users and why it shouldn’t be considered a competitor to established stablecoins like Circle’s USDC.

“It'll be quite different. Basically, the way that it works is it'll be backed by $SOL collateral. You'll have 0% borrowing, which will basically be subsidized by the staking yield. We'll be limiting growth to make sure it can grow sustainably. We'll also be running incentives with the $SLND token. There's hundreds of stablecoins in crypto. I think there is enough space for multiple of them to exist."

“Solana is Still Here”

By this stage, the Solana network has endured dozens of catastrophic market events and has been slandered for liveness failures and centralization. However, Solana continues to find a way to stay relevant in a crowded crypto market.

This year, Solana detractors have perpetuated the narrative that Solana is nothing without memecoins, a sector that has thrived following the launch of platform’s like pump.fun. Responding to these criticisms, Rooter commends the chain’s resilience and adaptability in the face of changing market demands.

“There was a time when, quote, ‘Solana was nothing without NFTs’, right? NFTs were the hottest thing and now that has died down a lot and Solana is still here, right? There was a time when people said ‘Solana is nothing without FTX’ and Solana is still here, right? So I think Solana will still be here whether or not there are meme coins. I think it's definitely done a good job of onboarding a lot of new users… But I think a lot of things in crypto come in cycles and I wouldn't be surprised if there's an end to the meme coin cycle.”

Read More on SolanaFloor

Which tokens performed best at Breakpoint?

$HONEY, $MPLX, $CROWN Lead Solana Ecosystem Token Performance During Breakpoint

Crypto Lending Explained