Are Crypto Exchange Listings Still Bullish for Solana Ecosystem Tokens?

Data shows centralized exchange listings might not be the positive catalyst they used to be.

Whenever emerging cryptocurrencies start gaining traction, rumors of upcoming listings on top crypto exchanges like Binance or Coinbase are met with rampant enthusiasm.

In the past, having assets on a centralized exchange used to mean deeper liquidity and greater exposure. CEX listings were once believed to be one of the most bullish price catalysts in the industry.

However, market dynamics throughout the current cycle indicate that this may no longer be the case.

Tracking Exchange Listings in the Solana Ecosystem

To gain a better understanding of exchange listing market dynamics, SolanaFloor collected data detailing price action across the Solana ecosystem’s most relevant assets during this cycle, with regard to its most prominent exchange listing. The following data points were recorded:

-

Current asset price

-

Asset price the day of exchange listing

-

Highest recorded price following exchange listing

The findings revealed sobering results.

|

Coin |

Price at Listing |

Post-listing High |

% Change |

Current Price |

% Change |

Listing Date & Exchange |

|

SLERF |

1.1 |

1.28 |

16% |

0.13 |

-88% |

March 18 2024, MEXC |

|

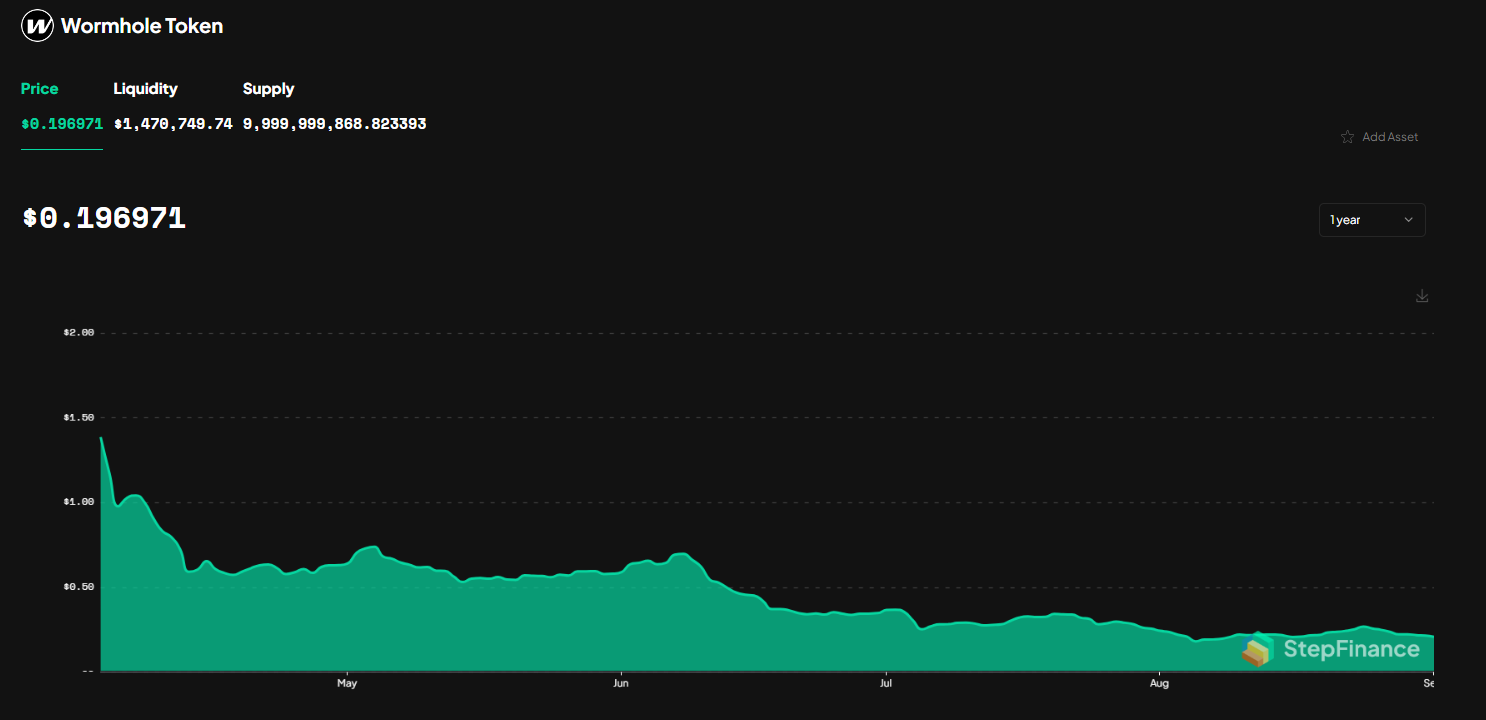

W |

1.4 |

NA |

NA |

0.2 |

-85% |

April 3 2024, Binance |

|

TNSR |

1.7 |

NA |

NA |

0.3 |

-82% |

April 8, Binance |

|

WEN |

0.00042 |

0.00049 |

16% |

0.00008384 |

-80% |

March 27, ByBit |

|

HONEY |

0.3 |

0.32 |

0.66% |

0.069 |

-77% |

January 17 2024, Coinbase |

|

BOME |

0.02281 |

NA |

NA |

0.0058 |

-74% |

March 16 2024, Binance |

|

IO |

4.49 |

6.33 |

41% |

1.44 |

-67% |

June 11 2024, Binance |

|

RAY |

3.86 |

16.64 |

331% |

1.47 |

-61% |

August 10 2021, Binance |

|

MICHI |

0.24 |

0.34 |

41% |

0.1 |

-58% |

June 3 2024, MEXC |

|

Orca |

3.65 |

7.93 |

117% |

1.87 |

-48% |

February 1 2022, Coinbase |

|

PYTH |

0.4 |

1.15 |

187% |

0.26 |

-35% |

Feb 1 2024, Binance |

|

BONK |

0.00002445 |

0.00004115 |

68% |

0.00001697 |

-30% |

December 15, 2023, Binance |

|

RENDER |

6.14 |

13.17 |

114% |

4.83 |

-21% |

November 27, 2021, Binance |

|

MEW |

0.005 |

0.008 |

60% |

0.004 |

-20% |

April 15 2024, OKX |

|

WIF |

1.81 |

4.8 |

165% |

1.54 |

-14% |

March 5, 2024, Binance |

|

JUP |

0.72 |

1.77 |

145% |

0.72 |

0% |

January 31 2024, Binance |

|

JTO |

2.06 |

4.25 |

106% |

2.15 |

4% |

December 7 2023, Binance |

|

DRIFT |

0.31 |

0.64 |

106% |

0.48 |

54% |

May 17 2024, Coinbase |

|

MUMU |

0.000018 |

0.0001 |

455% |

0.00003786 |

110% |

March 17, 2024, MEXC |

|

POPCAT |

0.27 |

0.96 |

255% |

0.58 |

114% |

June 21 2024, ByBit |

|

HNT |

1.41 |

9.58 |

579% |

7.22 |

412.00% |

July 12 2023, Coinbase |

Among the 21 analyzed assets, only 5 tokens are currently trading higher than when they were listed on their largest exchange. Additionally, two of the top performers, $POPCAT and $MUMU, are both smaller memecoins that are yet to be listed on major exchanges.

Are Exchange Listings a Sell-the-News Event?

With 76% of Solana ecosystem tokens currently trading at a lower price than the day they were listed on a centralized exchange, one could argue that exchange listings are a ‘Sell-the-News’ event.

However, evidence suggests that an exchange listing may provide tokens with enough bullish momentum to make a final high. Of all assets sampled, 10 tokens enjoyed price appreciations of over 100% following an exchange listing.

Conversely, while some tokens like $IO and $SLERF both notched small gains following an exchange listing, these assets have faced a near-constant downward trajectory ever since.

Older tokens launched in previous cycles, such as $RAY, $ORCA, and $HELIUM all enjoyed significant price surges following an exchange listing.

While this could suggest that listings were far more bullish catalysts in the past, it should be noted that market dynamics were vastly different. Liquidity and attention were split between far fewer assets, arguably making for a less competitive market.

Additionally, market participants are exploring onchain DeFi more frequently than in previous cycles. Based on Artemis data, Solana currently supports over 3.3 million daily active accounts. Increased onchain activity suggests that traders are no longer waiting for assets to be listed on exchanges before taking positions.

Hype Airdrops & Memecoin Listings Suffer

While older, more established tokens enjoyed the deepened liquidity and exposure provided by centralized exchanges, these factors could be considered a double-edged sword.

Recipients of hyped airdrops and memecoin traders have demonstrated a habit of using exchange listings in the form of exit liquidity. Two of the biggest airdrops of the year, $TNSR and $W, were both listed on exchanges almost immediately.

Since launch, neither of these tokens have traded higher than their initial listing prices. Additionally, viral memecoins like $SLERF and $BOME both made their exchange debuts at all-time highs and suffered devastating price drops in the following months.

Dynamics around centralized exchange listings are changing, and CEX-exclusive users are the most at risk. Taking measures to foster a healthier market environment, Binance announced changes to its listing policy.

The move aims to steer Binance away from low-float, high FDV (Fully Diluted Valuation) assets and reaffirm support for smaller projects with higher rates of circulating tokens.

While the data suggests that exchange listings could signal the market tops, it also needs to mentioned that many of these assets launched in H1, 2024. Market participants were euphoric during this period, with asset prices trading at inflated valuations. Crypto markets have since calmed down, with many assets entering sustained consolidation periods.

Read More on SolanaFloor

Could Central and Southern Asia be the next Solana hub?

Central and Southern Asia Explore Sustainable Alternatives Following Bitcoin Mining Boom

What are Crypto Airdrops?